Do you know how much it’s costing you to wait for interest rates to come down?

The days of 3% interest rates are long gone and those who were able to secure one are reticent to ever make a move. Those in a position to move are hesitant due to the higher interest rates. These rates are not predicted to drop below 6% until the end of 2025. If you’re waiting to move until the rates fall, it could cost you more than you think.

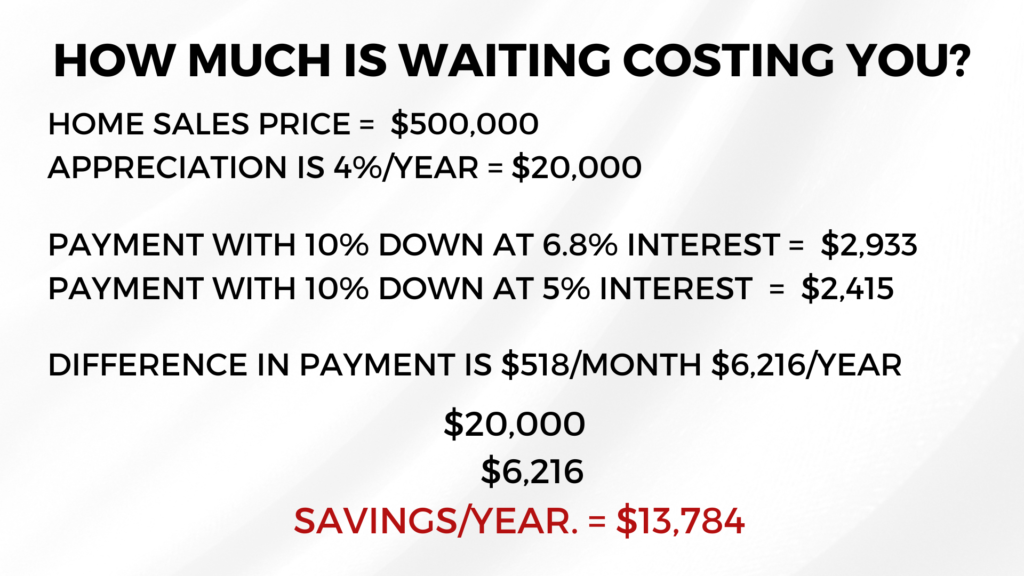

Waiting 2 years in the hopes of lower rates can cost you potentially $40,000, depending on your purchase price. Let’s take a look at the numbers.

Say you want to purchase a home that is $500,000. Historically, the average appreciation rate is 4% which would be $20,000. There is nothing on the horizon right now in Ann Arbor that is going to change that, especially with listing inventory currently down 16%. If you buy that home today at a 6.8% interest rate, your payment would be $2,933. If you wait to secure a rate of 5%, which could be 2 years from now, your payment would be $2,415. The difference is $518 a month or $6,216 a year.

In that year, you could have realized $20,000 in appreciation while you saved $6,216 in interest making a difference of $13,784 x 2 = $27,568 in the 2 years you waited for the rates to come down.

Another Thing to Consider

For every 1% the interest rates come down, a buyer can afford 10% more property. So even should the rates fall to 5%, affordability increases motivating more buyers. If you wait for a 5% interest rate, you may pay a higher price because the demand will be so much stronger.

Of course, every potential buyer has a different situation and reason for wanting to move. Whether you’re a first-time homebuyer or have gone through the process before, let’s discuss yours and see if this is a good time to purchase a new home. Contact us today at The Bouma Group, Realtors at 734-761-3060 or info@bouma.com and we’ll assess what’s right for you!